The Secret Of Info About How To Lower Your Student Loans

Federal student loans and most private lenders offer a discount if you set up automatic payment.

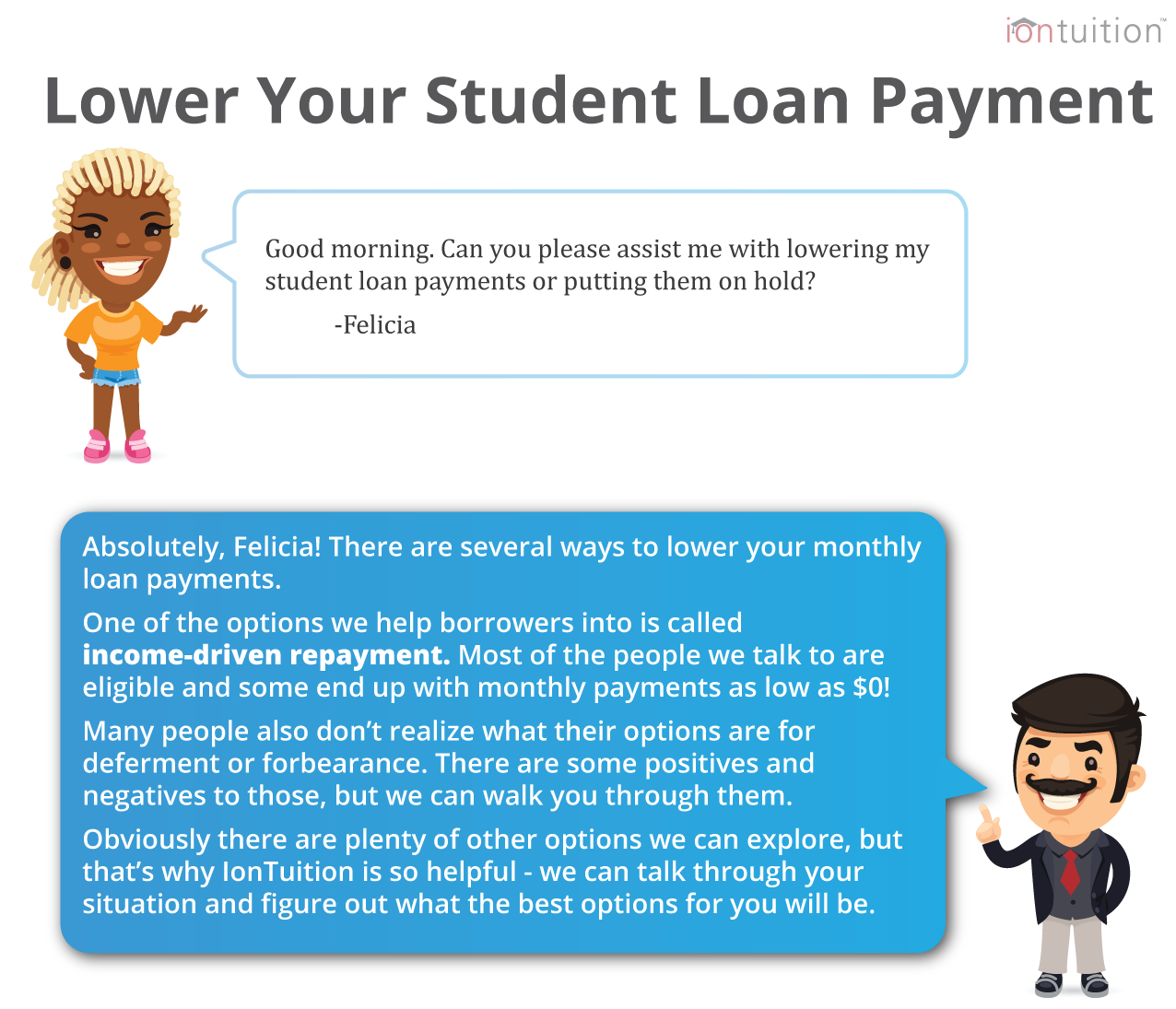

How to lower your student loans. Ways to lower your student loan payment 1. They might be with a. Refinancing your student loans may help you lower your student loan interest rate.

The forgiveness amount increases to up to $20,000 per borrower when they paid for school with the help of pell grants. Continue to make monthly payments. Make extra payments and ask your servicer to apply them to the loan principal.

3 pay more than your minimum payment paying a little extra each month can reduce the interest you pay and reduce your total cost of your loan over time. Here are 11 tips on the best ways to lower student loans each month. With private student loans, you can call your loan servicer and ask them to reduce your interest rates.

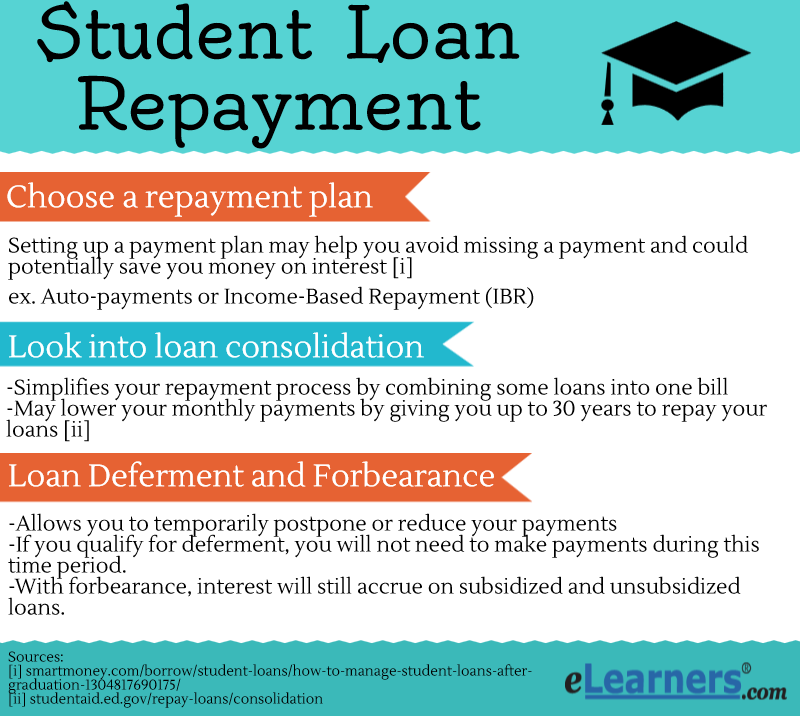

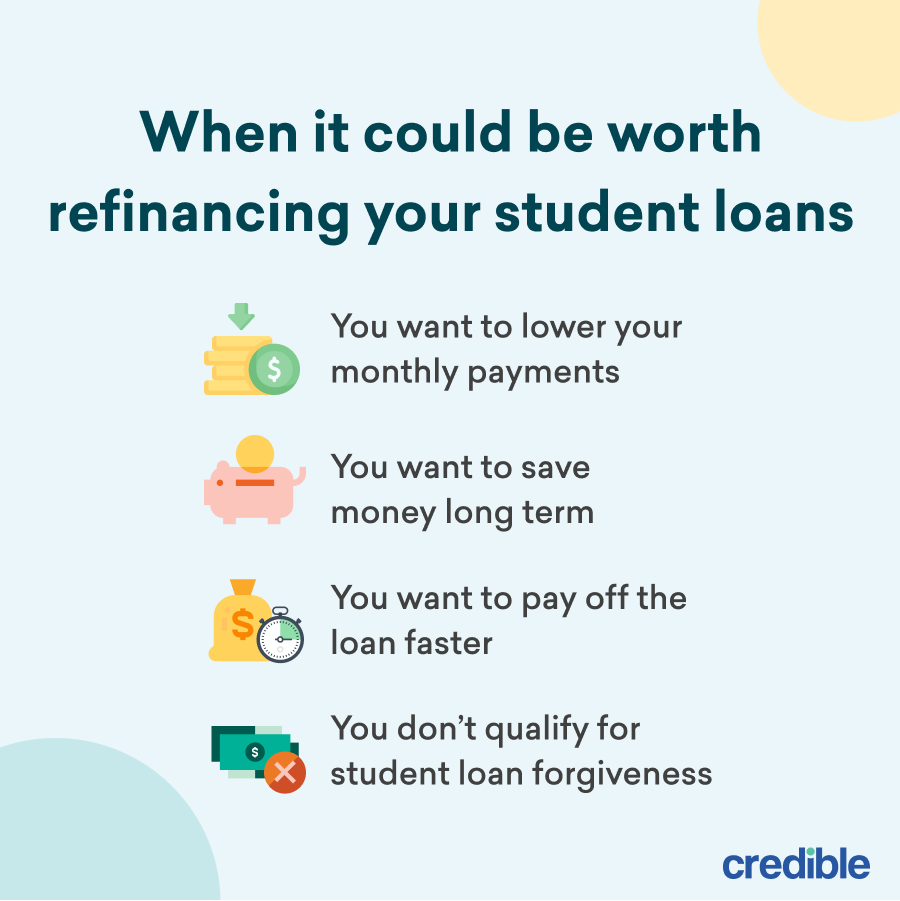

One way to lower interest rates during student loan repayment is to refinance the loan, meaning you take out a new loan to pay off the existing ones. For federal loans, it’s 0.25% off the interest. By choosing to refinance your student loans, you can often get a lower interest rate on your new loan if you have a good credit score.

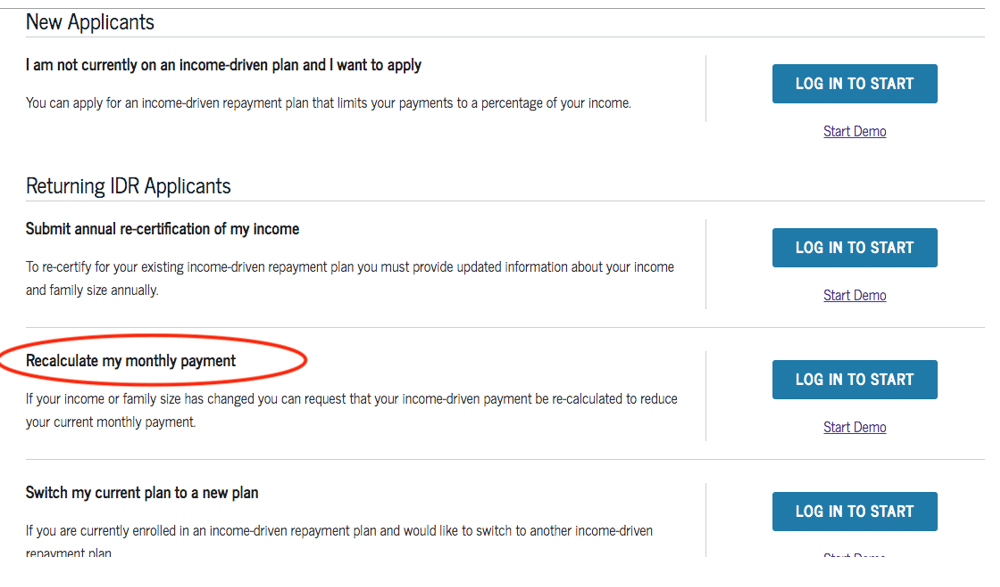

How to lower student loan payments for federal loans graduated repayment plan. This can help you get a lower monthly. Although the discount is small, it does reduce the total amount you pay over the life of the loan.

Here are some of the top ways to lower your interest rate on student loans. The rate you’re offered depends on your financial. Refinance your private student loans another way you can lower your private student loan payments and make them more manageable is to refinance.