Spectacular Tips About How To Buy On Margin

/margin-101-the-dangers-of-buying-stocks-on-margin-356328_V2-3a27513fade64c769d9abce43cec81f7.png)

5 5.purchasing on margin, risks involved with trading in a.

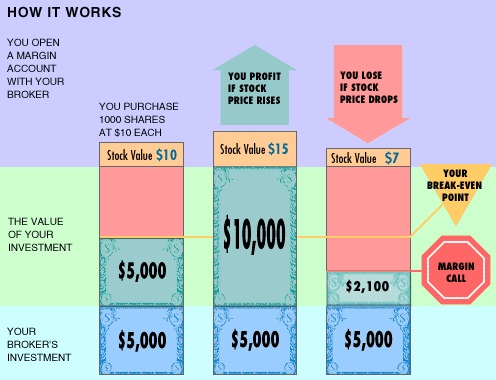

How to buy on margin. Try to keep the margin ratio at 40 percent or less. To buy on margin, you open a margin account with your brokerage firm and deposit a minimum of $2,000 in cash or marginable securities. Make sure the “actively trade stocks, etfs, options, futures or forex” button is selected 3.

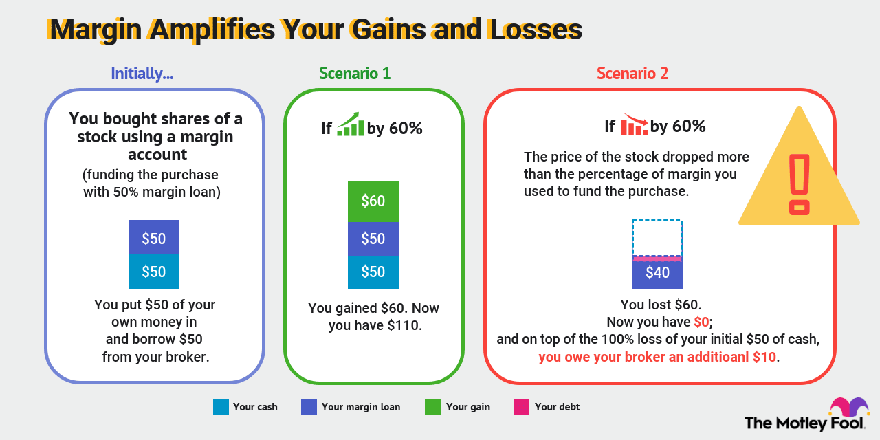

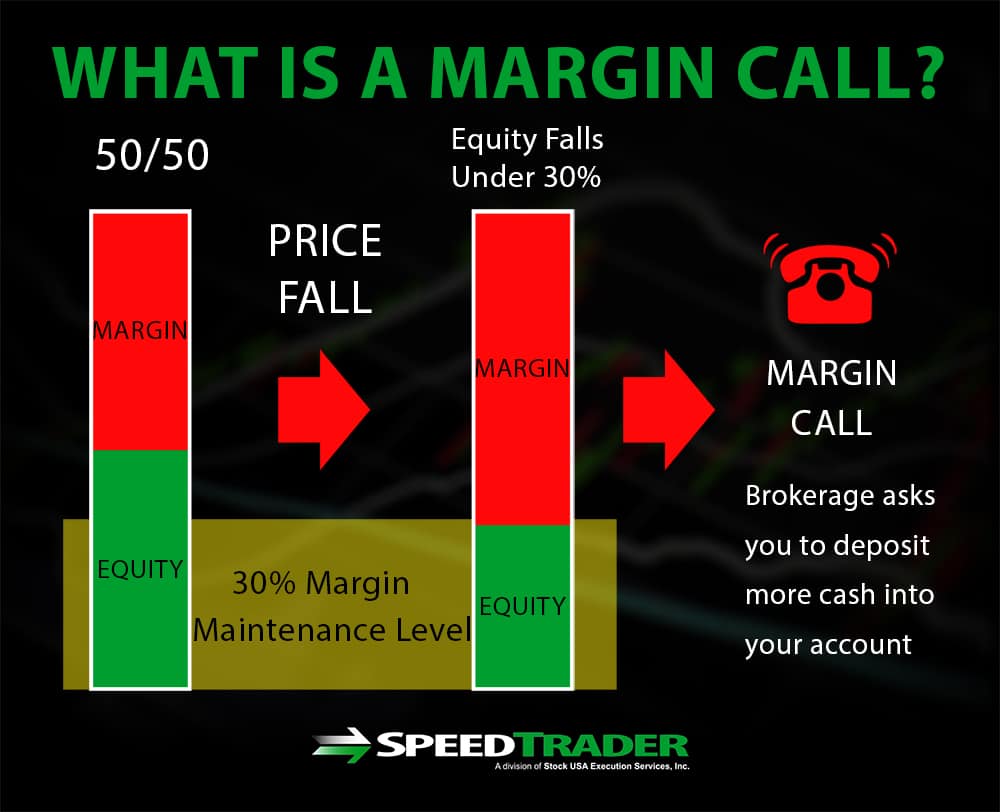

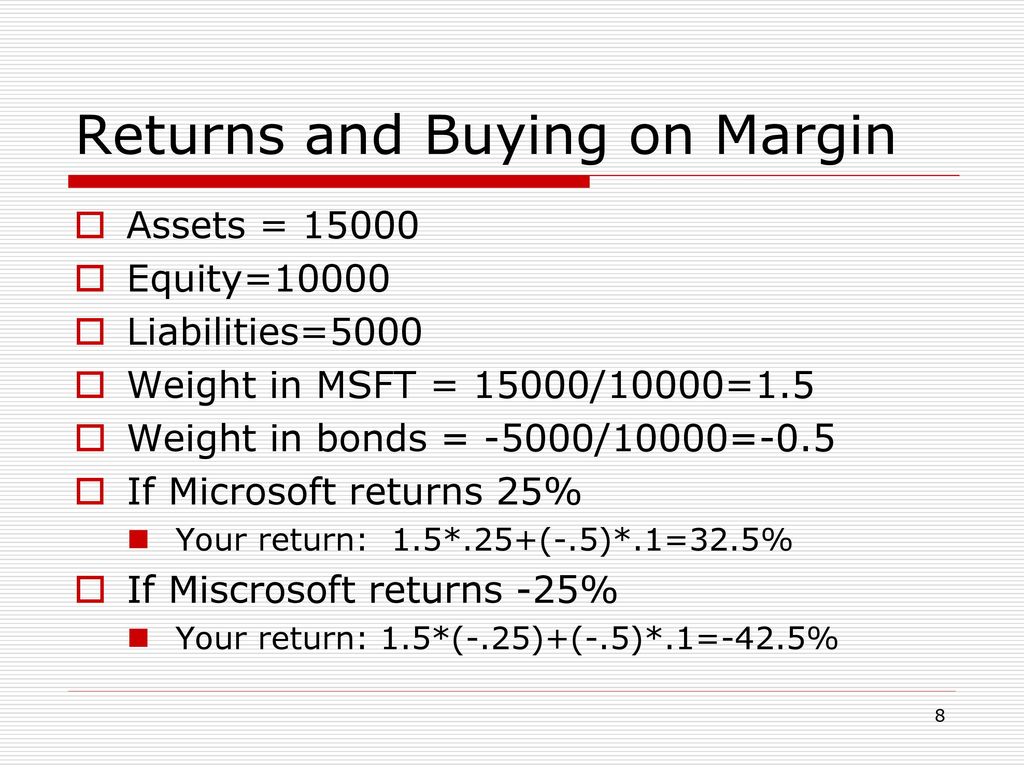

Microsoft down on margin guidance. It's critical to keep your equity higher than the margin requirements. Let's say you buy a stock for $50 and the price of the stock rises to $75.

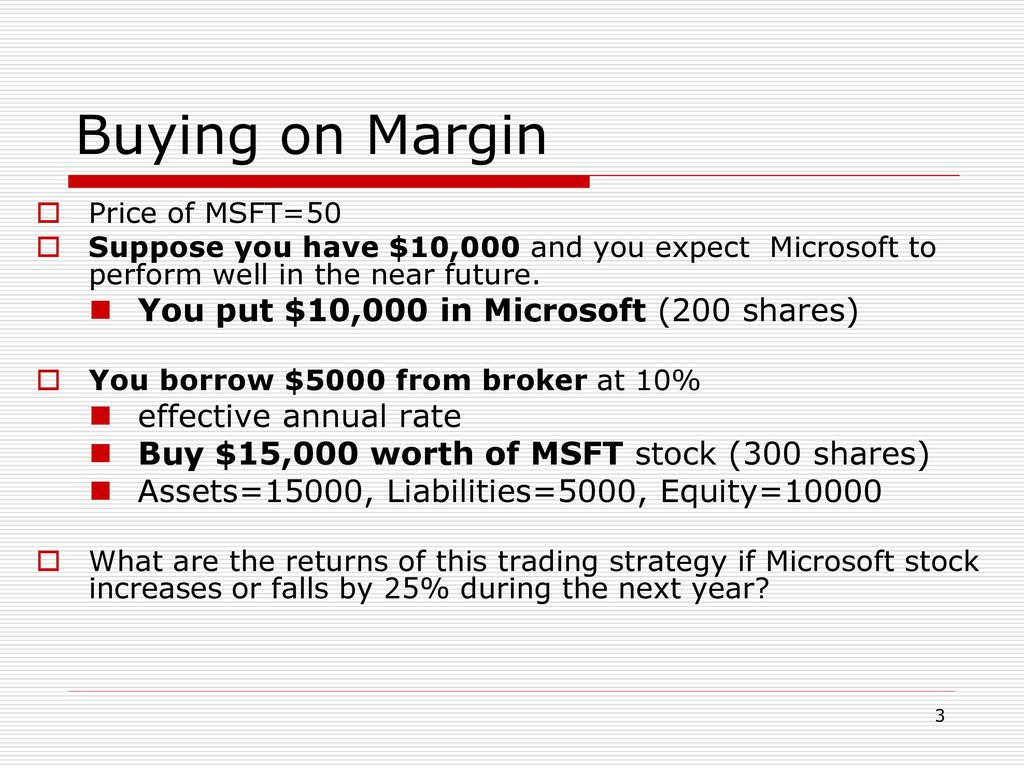

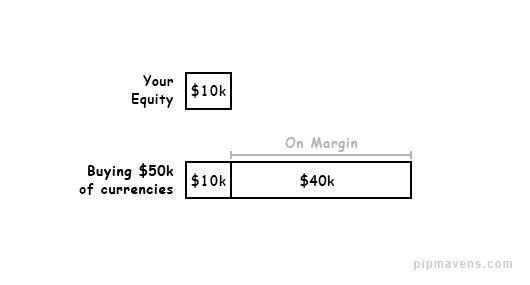

The value of this transaction is $50,000 (500 shares x $100). So, assume you own $5,000 in stock and buy an additional $5,000 on margin. Have ample reserves of cash or marginable securities in your account.

Open a td ameritrade account 2. Getting started with margin trading 1. Log in and from your account settings, click apply for margin. once approved, you can tap into your available funds at any time by placing a trade, writing a schwab one ® check, placing a.

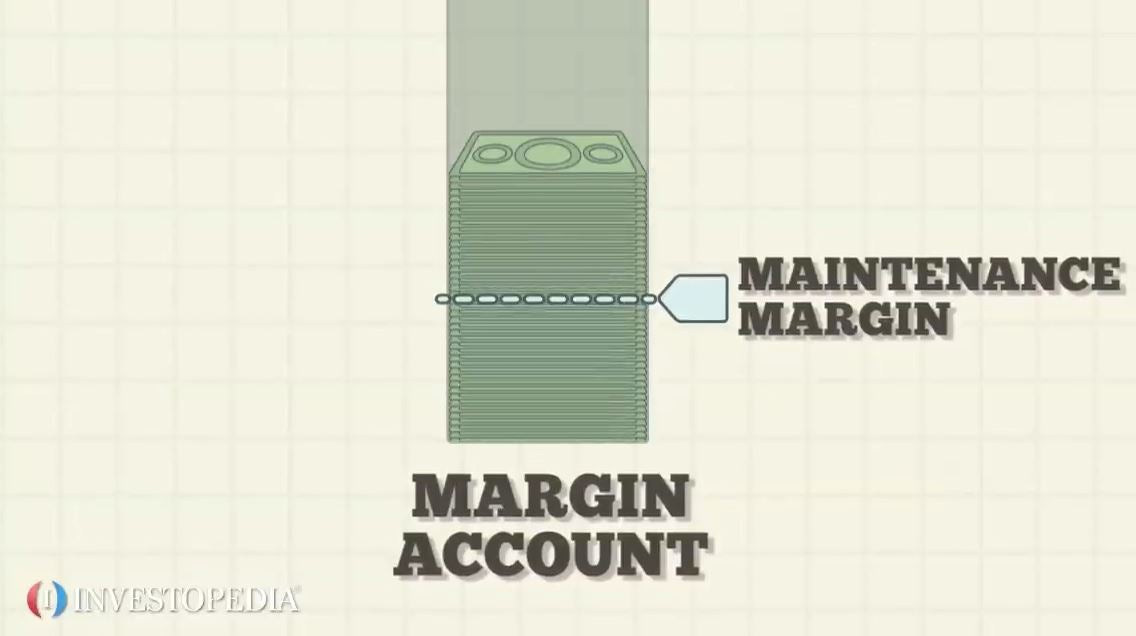

How to buy on margin step 1: Not all brokerages permit buying. When a customer has a margin account, they are capable of getting a loan from the broker so that they can buy stocks or other financial items.

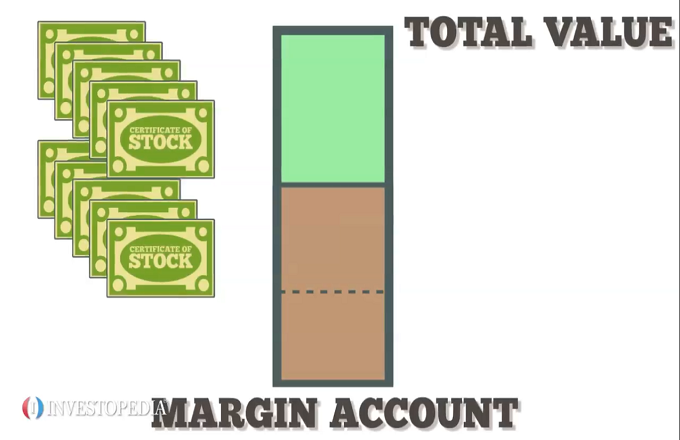

Fund your account with at. The buying power is the maximum amount that an investor can allocate to different financial instruments based on the equity value of the account and an estimated. The mechanics of buying on margin run as follows.